Yield; repay or invest

It is a recurring theme: “I have some money left to invest, should I pay off my mortgage or invest?” Many people are faced with this question, and both options are often chosen. But which yields the most?

Paying off your mortgage can provide low costs, investing can provide some extra. This article will address a number of considerations.

Pay off or invest: the considerations

The first argument that is considered is yield. What do you earn the most from? For that I compare investing in shares with redemption. The historical yield on the ‘All World’ index is ± 8%

The return on your mortgage is your mortgage interest minus ±30% (in connection with mortgage interest deduction). For a recent mortgage this will be around 2 to 3%. For an older mortgage perhaps 4 to 5%.

Do you want to reach the largest possible amount? Then investing wins because the expected return is probably higher.

The difference in returns is so great that even taking into account the return on capital gains tax (VRH), investing yields a better return.

Achieving Financial Independence

How quickly can you become financially independent?

You achieve higher returns by investing. And returns are quite important for the road to financial independence, but unless you have extremely low interest (around 2%), repayments are not inferior to achieving financial independence as quickly as possible.

For those seeking financial independence, repayment is a double-edged sword. Or actually three-edged sword: your achieved return (1), you have more left each month to invest (2) and you need less at the end of the line (3).

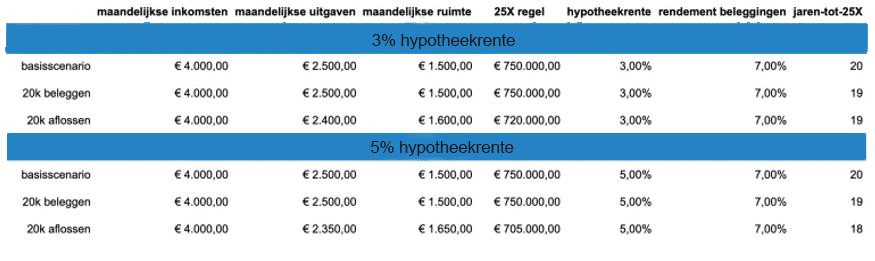

See scenarios below. If you can invest €20,000 freely, you will be financially independent in 19 years with both repayment and investment.

If you consider the number of years you are on your way to 25x your annual expenses, there is little difference between paying off or investing. However, when you factor in wealth tax, this works in favor of paying off your mortgage.

Taking into account the return on capital (VRH) repayment is even faster. You pay VRH on investments and not on repayments.

Flexibility; repay or invest

At first glance, investing seems the more flexible option. Paying off your mortgage, on the other hand, seems inflexible, since you are investing your capital in the “inflexible” real estate.

But is invested money really that flexible? Yes, you can withdraw it quickly by selling your shares. Provided there are buyers. And at what price? It may be that at the moment you need your money, the stock market is low. Then you can withdraw it quickly, but the costs are potentially high.

Increasing your partially repaid mortgage is possible with many mortgage providers. Often even with no or little costs. You do have to go through some administration for that. That is more effort than selling shares. But the stock market price has no influence.

This makes paying off your mortgage seem like the option that gives you more flexibility.

Taxes

Taxes strongly influence the choice between the two options. What is the effect of taxes?

Wealth tax

Invested money counts as assets. Assets are taxed in the Netherlands via the Wealth Return Tax (VRH) . VRH is somewhere between 1 and 2% depending on your assets. Expect about a third of your return. Repaying your mortgage does not count as assets. As a result, you do not pay VRH on that amount.

Mortgage interest deduction

A loan for your home, your mortgage, is stimulated via the Mortgage Interest Deduction (HRA). The interest you pay on your mortgage can be deducted from your income. This is beneficial because it means you pay less income tax.

The downside of the HRA is that you can deduct less from your taxes if you make extra repayments. That is why the return on accelerated repayments is lower than your mortgage interest.

Security

When you have a long-term fixed interest rate on your mortgage, your monthly payments are predictable. That is why most people choose a fixed interest period when taking out their mortgage.

Due to this fixed interest period, the return on accelerated repayment is also predictable: your mortgage interest minus the mortgage interest deduction is your return.

The lower outstanding loan amount also ensures lower monthly repayments. The result is a lower mortgage depreciation each month. And that gives a sense of security. Because your monthly payments are lower, you can better absorb a setback.

The stock market, on the other hand, is difficult to predict. This can make investing very uncertain and stressful (think of the whole of 2008 and December 2018). You have to be able to handle that. In the long term, the stock market has always done well, but that offers little comfort if you are deeply in the red.

Paying off your mortgage therefore seems by far the most secure option.

The final answer: should you pay off your mortgage or invest?

Is there a real winner? No. Both options have pros and cons. So ultimately it comes down to personal preference.

Your goal and risk appetite play the biggest role when you want to make a choice between paying off your mortgage or investing. Do you want to achieve financial independence? Then paying off is excellent. Do you want to realize the largest possible amount in the coming decades and do you have nerves of steel? Then investing probably wins.

| # | Repay your mortgage early | Additional investment |

|---|

| 1 | Low risk | High risk |

| 2 | Low yield | High yield |

| 3 | Not very flexible, but not fixed | Fairly flexible, but market dependent |

| 4 | Lowers your costs | Increase your income |

| 5 | Tax risk | Tax risk |

| 6 | Mortgage interest rates depress returns | Wealth tax reduces returns |

| 7 | Works great for financial independence | Works well for financial independence |

In both cases, you will achieve more financial strength and therefore more freedom. Paying off your home is simply also an investment. This is also the best way to look at it: paying off is a relatively safe investment with a lower return than investing. Logically, actually: return follows risk. Always.

Our reading tips

for the novice investor