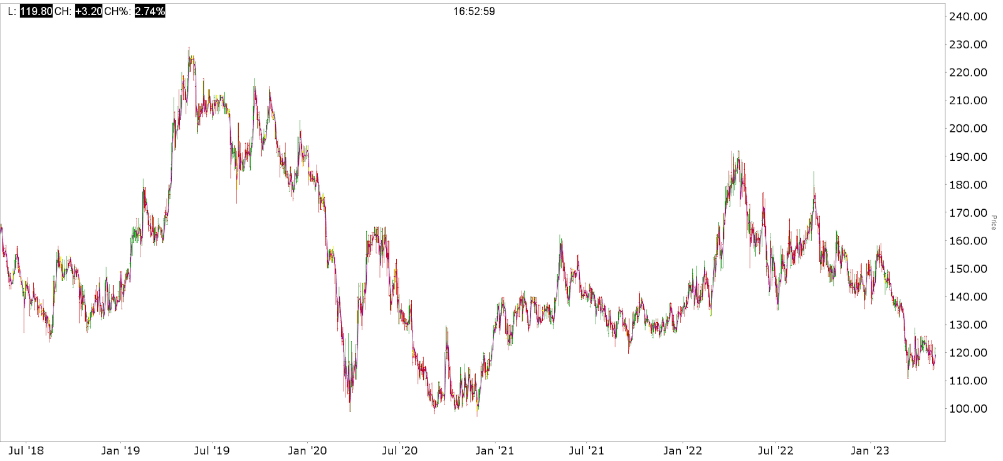

The English company Ecora Resources takes royalties on mining projects. The business model gives exposure to raw material extraction, but royalty companies have less risk than the mining companies themselves. Ecora has undergone a strategic repositioning, which has resulted in spectacular developments in turnover and profit. The share price had risen nicely, but has fallen again by around 40% after its peak and is approaching the bottoms of 2020. The company will not match the record profits of 2022 for the time being, but business is in good shape and the company is cheap by all standards. Sharesunderonetenner is therefore adding 1,500 shares of Ecora Resources PLC to its portfolio at the current price of around 118 British pence (GBX), or around 1.36 euros per share.

From banking spin-off to IPO

Ecora’s roots lie in the world of London investment banks. In the 1960s, the focus was on buying up interests in Australian oil, gas and coal mining. In 1996, the company was listed on the London stock exchange, but after the turn of the century, the coal activities declined and losses piled up. In 2013, Julian Treger took over as the new CEO and set a new strategic course. Unlike his predecessor, he was not an engineer, but an investment banker. He decided to phase out the interests in Australian coal mining and to focus on metals of the future, such as cobalt. In 2021, an important milestone was reached because half of the turnover came from new metals. For Treger, that was the moment to make way for his successor Marc Bishop Lafleche, who, like him, was an investment banker. Lafleche continued the course with gusto and decided to change the company’s name from Anglo Pacific to Ecora Resources in October 2022.

Royalties, superior business model

Royalty companies in raw materials have more in common with financing companies than with miners. They invest alongside the mining companies in mining projects, in return for which they later receive a portion of the proceeds of the project in question. For the miners, royalties are often more advantageous than bank financing or share issues, because royalty financing is more flexible, long-term and does not cause profit dilution. For investors, the advantage of royalty companies over the mining companies themselves is that the results are more stable and the risks are therefore lower. After all, royalties are paid on the turnover or proceeds of a project and not on the profit. The operational costs remain the responsibility of the miner. With inflation high, the royalty companies are much better positioned than the miners who see their profits evaporate due to higher costs.

Strategy

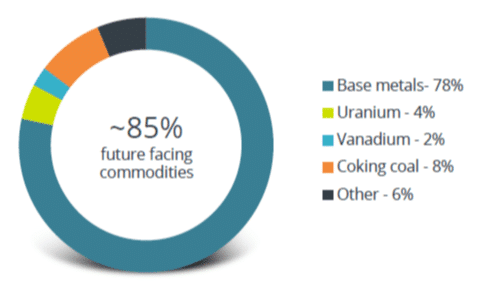

In recent years, Ecora has phased out the majority of royalties on Australian coal projects, with only the Kestrel project remaining until 2026. Coal has been replaced by metals such as copper, cobalt, nickel, iron and uranium. The outlook for these metals is favourable as they are widely used in future products such as electric vehicles, wind turbines and electricity infrastructure. The plan is to achieve 90% of revenue from future-oriented commodities by 2026, a figure that should increase to 100% by 2028. The diagram below shows the composition of the book value of the royalty portfolio in terms of exposure to different commodities.

The current portfolio

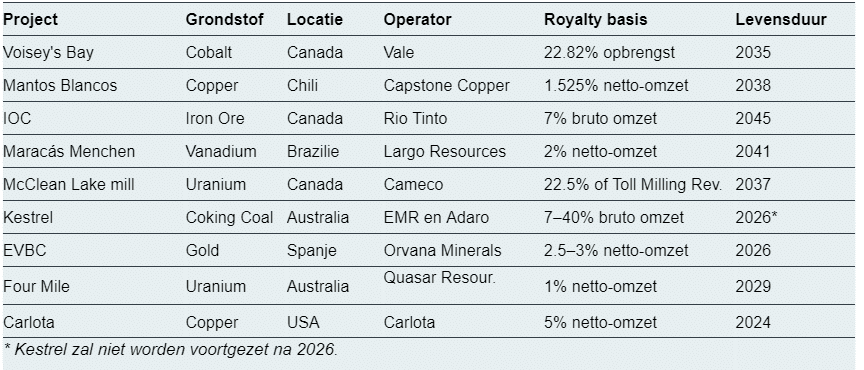

Key royalties acquired in recent years include Voisey’s Bay, a world-class cobalt mine in Canada, and Mantos Blancos, a copper mine in Chile. The royalty on Voisey’s Bay was acquired in February 2021 for $205 million from Brazilian operator Vale, which will pay 22.8% of the project’s proceeds to Ecora until 2035. Mantos Blancos is a $50 million investment in a Chilean open-pit copper mining project, from which Ecora will receive 1.58% of the proceeds until 2038.

In total, the portfolio contains eighteen royalties, nine of which relate to projects that are already producing and therefore generating revenue. In addition, there are six royalties on projects that are being developed and will become productive within a few quarters. Finally, there are three so-called ‘early stage’ royalties from long-term projects that have yet to start development. The table below provides an overview of the producing royalties.

In 2022, royalties were raised from a number of projects of mining company South32, a spin-off of the Australian BHP. The deal involved a 2% royalty on the West Musgrave project to develop a copper and nickel mine in Western Australia and a royalty on the Santo Domingo project to develop copper and cobalt in Chile. As part of the deal, South32 has become the largest shareholder in Ecora with 44 million shares representing a 17% stake.

Financial results

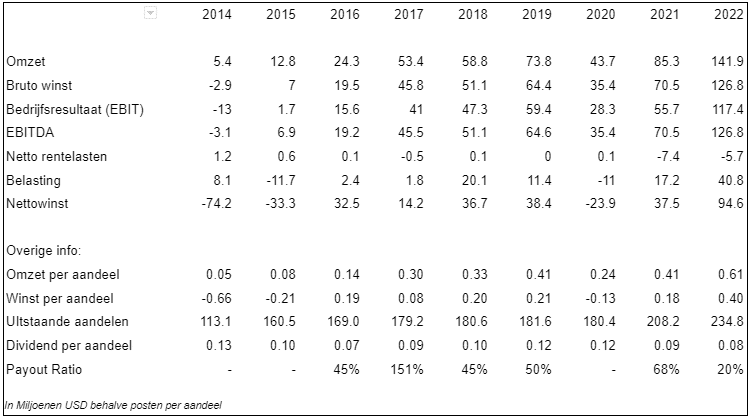

The success of the new strategy is undeniable. The table with the multi-year financial overview shows that the company was heavily in losses in 2014. Management made significant cost cuts, sold a number of royalties and issued new shares to free up resources for new royalties, particularly in copper, iron and nickel. After that, turnover increased sharply so that from 2016 onwards black figures were written again. The financial year 2020 was an exception due to the closure of the Australian coal mine Kestrel. The mandatory closure of the mine due to the corona pandemic caused a drop in turnover, which led to a loss below the line. Financial year 2022, on the other hand, was again an absolute top year, although that requires explanation.

Financial year 2022

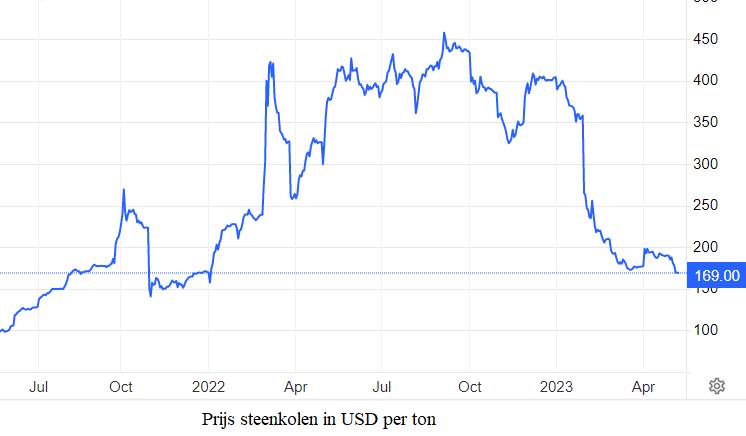

Portfolio revenues reached a record $143 million, up from $86 million in 2021. Net income came to $95 million, almost triple the 2021 figure, which was also a record year. The abundant cash inflow reduced net debt from $90 million to $36 million. The exceptional performance was driven by a tripling of coal prices and an upward revision of royalty rates by the Australian state of Queensland. Revenue contribution from Kestrel, the only coal mine remaining in the portfolio, skyrocketed by 123% to $107 million. More than two-thirds of total portfolio revenues of $143 million thus came from Kestrel.

Incidentally, the price of coal has now fallen as fast as it had risen, so that according to analysts, turnover will fall by 40% in 2023 and the EBITDA will come to $74 million. Nevertheless, the share is still cheap, especially when compared to other royalty companies.

Comparison with peers

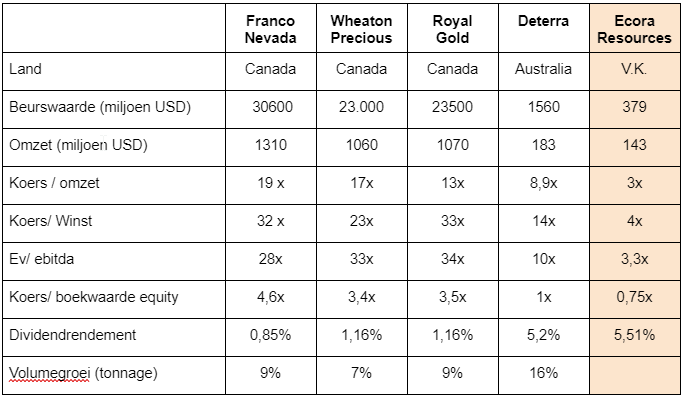

Ecora is an odd duck in the royalty world, as almost all of the players in the sector are focused on precious metals, primarily gold, and almost all of them are Canadian. Ecora is also much smaller, with fourteen employees. The table below provides key figures for the major players in the sector and their valuation multiples. Ecora is by far the cheapest by any measure, although the difference is magnified because 2022 has been an exceptionally good year.

Conclusion

Ecora is well positioned for the future. The management team is competent, only takes royalties on high-yielding projects in safe jurisdictions, is invested in the right metals and has enough royalties on projects that are currently being developed to become productive in the future. Coal producer Kestrel will no longer contribute from 2026, but the six mining projects that are in development will more than compensate for the loss of revenue by then. Now that the share price has almost completely fallen, the stock is certainly cheap and the risks are also much lower than those of the miners themselves. Ecora is much smaller than its peers, but that also makes it more effective and the company can strike quickly when a good deal comes along.

Ecora has a very strong position in metals that are essential for sustainable products, such as electric vehicles, wind turbines and electricity infrastructure. Sooner or later, Ecora will have to come into the picture of ESG investors who jointly manage a huge amount of capital that must find its way to a limited number of companies that meet the sustainability criteria. We expect the price to return to its old high of GBx 230 within a few years. We are therefore including 1,500 shares of Ecora in the portfolio of Aandelenondereentientje at the current price of around 118 British pence (GBX), or 1.36 euros per share.

The author has a position in Ecora.

Ecora Resources Fundamentals

ISIN Code: GB0006449366

Ticker: ECOR

Exchanges: London and Toronto

52-week high: GBP 184

52-week low: GBP 110

Price at time of writing: GBP 119

Number of shares: 234 million

Market capitalization: $380 million

Enterprise value: $421 million

Price-earnings ratio: 3.66x

Price to Net Asset Value: 0.75x

Dividend yield: 5.5%

Website: www.ecora-resources.com